Once all 500 units are scanned, the inventory count should have increased by 500. A perpetual inventory system will learn from the sales data of the past 4 years, and automatically raise your reorder threshold from 25 units to 50 units. This way, you can reorder stock sooner than you normally would and prevent stockouts. On your income statement, the amount of money the customer pays for the items — in this case, $30.00 — is recorded as a credit to revenue.

What Are the Disadvantages of a Periodic Inventory System?

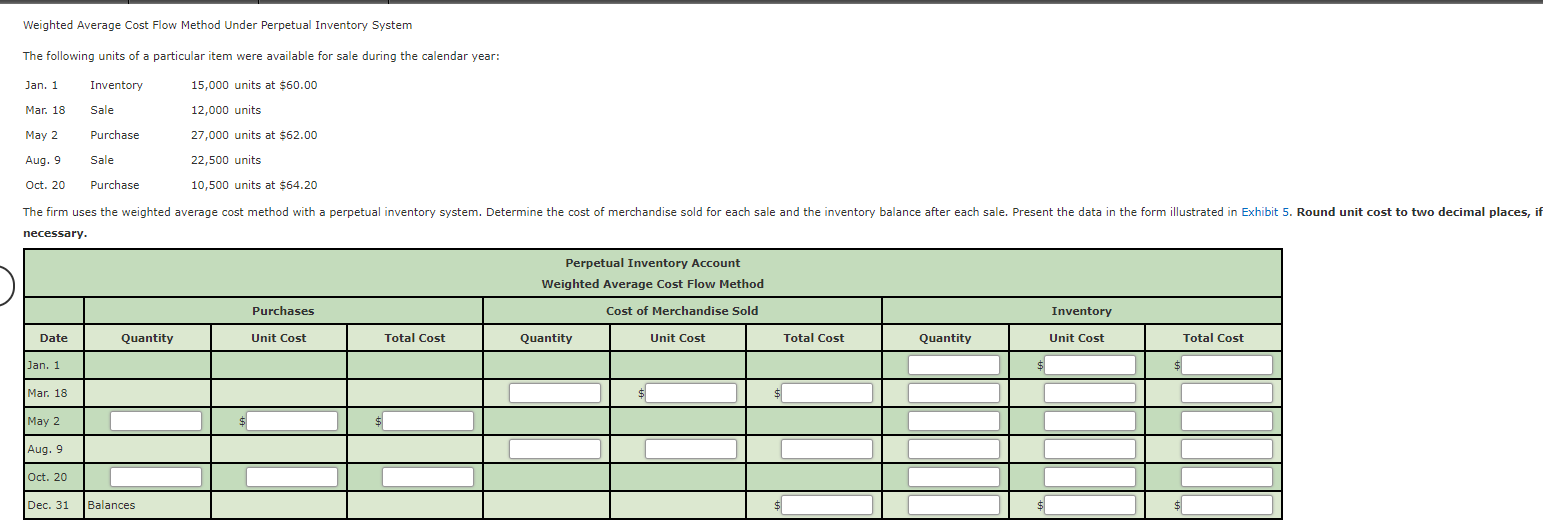

Under this method, the cost of goods sold (COGS) is calculated by dividing the cost of goods available for sale by the total number of units in inventory. It gives an average cost per unit, used to value the COGS and ending inventory. A perpetual inventory system is a real-time computerized system that constantly monitors and updates inventory levels as goods are received, should i claim scholarships and other awards on my taxes sold, or returned. A perpetual inventory system will use that sales data and automatically increase your reorder threshold accordingly. This ensures that you reorder additional anticipation inventory to prevent stockouts during this period of increased sales. A perpetual inventory system lets you know exactly how much inventory you have at any given point in time.

What is the Difference Between Raw Materials Inventory and Finished Goods Inventory for Ecommerce?

Sellers can determine inventory cost using the finished goods inventory formula. For instance, the system must ensure that workers quickly scan any new inventory. These analyses are more complex in periodic systems since the system accumulates data at a high level. In a periodic inventory system, you might manually keep track of your inventory. The perpetual inventory does not need manual adjustment by the company’s accountants.

- It means that the COGS is calculated based on the cost of the most recent inventory items, while the ending inventory is based on the cost of the oldest inventory items.

- As soon as a unit is scanned, the perpetual inventory system automatically increases the inventory count for that SKU by 1.

- To calculate inventory, you need to set up a system where every piece of inventory is entered into the system or deducted from it as it’s purchased or sold.

- It uses historical inventory and sales data to predict future sales trends and cycles and ensure you have the optimal stock at the right time of year, such as the holiday season.

Is the Perpetual Inventory System Right For Your Business?

During periods of inflation, a LIFO system may be more appropriate for companies that do not wish to pay as much in taxes, because it will show a higher COGS expense and a lower net income. Therefore, your company has a lower tax liability in a LIFO system, because businesses get taxed on profit. The Internal Revenue Service allows companies to use LIFO in their tax accounting, even when they use FIFO in their financial statements. Other businesses that need perpetual inventory include those that specialise in drop shipping, where the manufacturers ship directly to customers or those who specialise in trade and distribution.

The method helps you to reduce inventory costs and provides real-time inventory handling, detailed reporting, and accurate demand forecasting. Explore how perpetual inventory systems enhance accuracy in inventory management and influence financial reporting through various valuation methods. Perpetual inventory is an accounting method that records the sale or purchase of inventory through a computerized point-of-sale (POS) system. The perpetual method allows you to regularly update your inventory records to help prevent situations like running out of stock. For e-commerce companies that are expanding quickly, a perpetual inventory system is the best option. A periodic inventory system has weaker stock control and a significant likelihood of discrepancy.

Optimizing Sales on Account for Financial Stability

In other words, it can be set up to automatically issue purchase orders whenever stock levels fall below the required threshold. Businesses dealing with inventory have minimum required stock levels they need to maintain for every type of good. Whenever a stock amount falls below this minimum, the system sends a notification suggesting you order more stock. Which of these two approaches is best depends mainly on the quantity of your inventory.

But, in general, accounting inventory is exactly the same, or almost the same, as the actual inventory. Perpetual or continuous inventory is an accounting practice that records inventory changes in real-time, without requiring periodic physical stock counts. Whenever goods are sold or received, the inventory level is adjusted accordingly. Note that for a periodic inventory system, the end of the periodadjustments require an update to COGS. To determine the value ofCost of Goods Sold, the business will have to look at the beginninginventory balance, purchases, purchase returns and allowances,discounts, and the ending inventory balance. Under the perpetual inventory system, the cost of sales grows every time there is a sale, increasing the expense account.

The general examples of such expenses include freight-in and insurances expense etc. Each time the merchandise is sold, the related cost is transferred from inventory account to cost of goods sold account by debiting cost of goods sold and crediting inventory account. In this section, we will discuss some of the key formulas used in perpetual inventory systems to help businesses effectively manage their stock levels and make informed decisions. These formulas include COGS, economic order quantity (EOQ), weighted average cost, and gross profit. A perpetual inventory system allows for quick identification and resolution of issues such as stock discrepancies or data entry errors. Since updates occur in real-time, businesses can promptly address any inconsistencies that may arise.

A perpetual inventory system lowers inventory management costs by automatically calculating stock holding costs, replenishing low-stock items and saving labour on manual stock counts. A perpetual inventory system is a great choice for fast-growing ecommerce businesses. In addition to a lower likelihood of discrepancies and stronger stock control, brands can centralize inventory management, optimize stock levels, and much more. Since a perpetual inventory system accounts for inventory continuously, your end-of-year inventory balance is calculated instantaneously when the year ends. This helps to make sure you have accurate inventory numbers to report on for accounting purposes. A perpetual inventory system has a lot of advantages for ecommerce businesses of all sizes.